By Ansgar Belke and Christian Dreger

http://ideas.repec.org/p/rwi/repape/0448.html

Policy Brief:

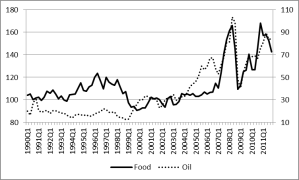

In the pre-crisis period of globalization, the rapid integration of huge emerging market countries such as China and India into the world economy led to high demand in global food and energy markets. The depreciation of the US-dollar caused further upward pressure: While international prices are often denominated in dollar, many producers calculate the price in their own currency. Oil and food prices have moved in parallel in recent years (Figure 1). This pattern is probably also driven by legislative mandates to use cropland for the production of biofuels and the increasing role of commodities in international asset portfolios. While the global financial crisis led to a decline in the world demand for commodities, causing oil and food prices to fall, they started to rise again thereafter.

Figure 1: Oil and food prices

Note: IHS Global Insight (oil, dashed line, right axis), Food and Agriculture Organization of the United Nations (food, solid line, left axis).

Rocketing oil and food prices can affect the real side of the economy, depending on the degree of their transmission to the domestic price level. Price increases may depress the purchasing power of private households and can trigger production losses, as firms will choose labour and capital input to match the shifts in relative prices. In the case of price decreases, a reversal is expected, given that the adjustment pattern is symmetric. The effects should be especially visible in low-income net importing countries. As food represents a relatively large share of the consumption baskets of private households, accelerating prices can lead to increasing poverty and political instability. For instance, high and volatile food prices might have contributed to social unrest in the eve of the Arab Spring. The transmission of oil and food prices to consumer prices is at the centre of our paper.

The degree of price transmission can differ across countries, depending on whether own resources can be mobilized to mitigate the effects. Policy responses may also shape the outcome. In case of price hikes, governments can react by rising subsidies or improved safety nets to protect poor households. Export restrictions might be implemented to stimulate supply at domestic markets. Wage-price spirals may occur in countries with wage and price indexation. To combat the rising inflation pressure, central banks may tighten their monetary policy stance, but with adverse effects on the real economy. Countries with international reserves may react by appreciating their currencies. However, an appreciation hurts firms engaged in export-oriented activities and hampers the build-up of import-competing industries. While such policies could dampen the adverse effects of food and oil price shocks, they can contribute to higher instability in international markets and decrease the incentives of domestic farmers to respond with higher production. In addition, policies are not sustainable, if they imply a deterioration of public budgets.

In a recent study, we have studied the impacts of global food and oil prices on consumer prices for a sample of MENA countries: Algeria, Egypt, Jordan, Libya, Morocco, Syria and Tunisia. The selection is motivated by data availability. All countries are net food importers. Due to strong population growth, the vulnerabilities will likely increase in the future. The region is the most food import dependent region in the world. Food dependency ratios, i.e. net imports over private consumption exceed 50 percent on average.

As the analysis shows, exchange rate movements act as shock absorbers only partially. Estimated food price elasticities are about twice as large as the oil price elasticities. Hence, the impacts of food prices on national consumer prices dominate. The response of real GDP seems to be very limited both in the long and short run. We found also asymmetries in the relationship, i.e. a lower reaction of domestic consumer prices after negative shocks in international prices. This points to the existence of rigidities to downward price adjustments. These rigidities might have been reinforced by extended price subsidies in many countries.

In fact, energy and food subsidies have been used for decades and constitute the major part of the social security safety net in the region. According to the IMF, food subsidies were about 0.7 percent of MENA GDP in 2011. Energy subsidies amounted to $240 billion, which is about 8.5 percent of overall GDP or 22 percent of the government revenues. Furthermore, the region holds more than 13 percent of global wheat stocks. Despite some failures, the strategic food reserves could insulate the region from off-shore price disturbances. On the other hand, subsidies can also increase instability in international markets, as the incentives to food producers are distorted. By comparing the adjustment pattern across countries, our analysis provides an indirect evaluation of the success of policies implemented to cushion the domestic economies from global price shocks.

In this vein, we feel legitimized to consider government interventions to be just another characteristic affecting the pass-through to national inflation. It is supposed that a country should generate sufficient foreign exchange from exports to finance food imports in order to be food secure. Keeping prices and imports of food as stable as possible is achieved not only by importing enough food, but also by interventions based on food reserves and price subsidies. These practices will cost even more in case of global price shocks. For instance, the government will have to double the subsidy paid per unit of imported food in case of a shock doubling the world food price in order to keep imports at levels prevailing at the old international prices.

Regardless of the assumption that food and oil prices fluctuate simultaneously, MENA oil-exporting countries, such as Algeria and the Gulf Council countries, should benefit on the macro level in case of rising oil prices, having more fiscal space to cover food imports and the costs of interventions. The situation in the oil-importing countries will differ and its fiscal capacity will depend on other factors as well, including its relations with the region and the outer world through remittances and trade.

Leave a comment